Basiccharacteristics

Thesharpdeteriorationofallormostofthefinancialindicatorsinthefinancialsectorhasaffectedthestabilityanddevelopmentoftheeconomyofrelevantcountriesorregionsandeventheworld.

Themainperformancesare:

1.Thestockmarketplummeted.Itisoneofthemainsignsoftheinternationalfinancialcrisis.

2.Capitalflight.Itisanothermajorsignoftheinternationalfinancialcrisis.

3.Normalbankcreditrelationshavebeendestroyed,accompaniedbytheemergenceofbankruns,shortagesofmoney,andalargenumberofbankruptciesoffinancialinstitutions.

4.Theofficialreservesaregreatlyreduced,thecurrencydepreciatessignificantlyandinflation.

5.Difficultiesinrepayingdebts.

Crisischaracteristics

First,theeconomyhascontinuedtogrowatahighlevelformanyyears;

Second,isthelargeinflowofexternalfunds;

Three,yesDomesticcreditisgrowingrapidly;

Four,itisageneralover-investment;

Five,thepriceofstocks,realestateandotherassetsarerisingrapidly;

Six,itistradeThedeficitcontinuesandcontinuestodeteriorate;

Seven,currenciesaregenerallyovervalued.

Origin

Theglobalfinancialcrisisbeganinthe19thcentury.In1873,theGermanandAustrianeconomiesprospered,attractingcapitaltostayinChina,andthesuddensuspensionofexternalcredit,leadingtothesuddensuspensionofAmerican·TheoperatingdifficultiesofCookCompanyappeared.

TaketheU.S.subprimemortgagecrisisthatbeganin2007asanexampletointroducetheoriginoftheglobalfinancialcrisis:

TheU.S.subprimemortgagecrisisthatoccurredin2007developedintoafull-scalefinancialcrisis.Therealeconomyhaspenetratedandspreadtotheworld,whichhasaseriousimpactontheworldeconomy.ButthesubprimemortgagecrisisaloneisnotenoughtocausesuchaseriousfinancialcrisisintheUnitedStates.TheUSfinancialcrisishasdeeperandbroaderroots,includingatleastthefollowingthreepoints:

TheInternetbubbleproblemhasnotbeenresolved.Inthe1990s,theUSITindustrywasbooming,drivingtheUSeconomytoprosperity,butitalsocontainedalotofbubbles.However,theUnitedStateshasnotresolvedthisproblem,andinsteadattemptedtocoveritupwiththeprosperityoftherealestateindustry.Sincethe21stcentury,theFederalReservehascontinuouslycutinterestrates,financialinstitutionshavesimplifiedhousingpurchaseprocedures,canissueloanswithoutdownpayment,andevenfalsifiedcreditratingstoencouragesubprimemortgages,whichhasledtoanincreasingrealestatebubble.TherealestatebubblehasmergedwiththeInternetbubblethathasnotbeenresolvedinthepast,andrisksinthefinancialmarkethaverapidlyaccumulated.

Thevirtualeconomyisseriouslyoutoftouchwiththerealeconomy.Thedualityofcommodityusevalueandvalue,thedualityofphysicalformandvalueform,dividethenationaleconomyintotwoparts:realeconomyandvirtualeconomy.Thetwopartsshouldberoughlythesame,butbecausethevalueofthecommodityisdifferentfromtheusevalueinoperatingchannels,trajectories,methods,regulatoryagencies,andoperatingentities,thevalueoftendeviatesfromtheusevalue,whichleadstoadisconnectbetweenthevirtualeconomyandtherealeconomy.Whenthisdivergencereachesaveryseriousdegree,severeinflation,hugefiscaldeficitsandforeigntradedeficitsarelikelytooccuruntilthefinancialcrisisandeconomiccrisis.OneoftherootcausesoftheoutbreakoftheUSfinancialcrisisisthatthevirtualeconomy(mainlyrepresentedbythefinancialindustry)isseverelyseparatedfromtherealeconomyandexcessivelyinflated.

TheUnitedStatesimplementsadeficitfiscalpolicy,ahigh-consumptionpolicy,andanexportcontrolpolicy.TheU.S.governmentreliesonfiscaldeficitsorborrowingtooperate.Americanhouseholdsalsorelyonborrowingtosupportadvancedconsumption.Householddebthasexceeded15trillionU.S.dollars.IntheUSindustrialstructure,capitalandtechnology-intensivehigh-techindustriesareadvantages,whilelabor-intensivedailynecessitiesindustriesaredisadvantages.ThisdeterminesthattheUnitedStatesmustimportlabor-intensiveproductsandexporthigh-techproducts.However,whiletheUnitedStatesimportsalargenumberoflabor-intensiveproducts,itstrictlyrestrictstheexportofhigh-techproductswithexportcontrolpolicies.Thishasledtoserioustradeimbalancesandagrowingtradedeficit.Howtosolvetheproblemoffiscalandtradedeficits?ItdependsontheglobalissuanceofUSdollars,Treasurybonds,stocksandalargenumberoffinancialderivatives.Throughsuchvirtualchannels,theworld'sphysicalresources(naturalresources,laborresources,andcapitalresources)areconstantlyflowingintotheUnitedStates.TheUnitedStatesproducescurrency,andothercountriesproducegoods.However,itisunsustainableafterall.

Milestones

2007

February13U.S.mortgagerisksbegantosurfaceMortgagebusinessincreasedbyUS$1.8billioninbaddebtprovision.CountrywideFinancialCorp,thelargestsubprimemortgagecompanyintheUnitedStates,reducedlending.,S&Pfell2.04%,Nasdaqfell2.15%

April4thAftercuttinghalfofitsemployees,NewCenturyFinancialfiledforbankruptcyprotection

OnJuly10thS&Ploweredtheratingofsubprimemortgagebonds,theglobalfinancialmarketfluctuated.

July19BearStearns'hedgefundswereonthevergeofcollapse

August5thWarrenSpector,presidentofBearStearns,thefifthlargestinvestmentbankintheUnitedStates,resigns

August6thb>AmericanHomeMortgage,arealestateinvestmenttrustcompany,filedforbankruptcyprotection

August9th

August10Thesubprimedebtcrisisspread,andtheEuropeanCentralBankintervened

August11CentralbanksaroundtheworldinjectedmorethanUS$326.2billionin48hourstorescuethemarket.TheFederalReserveinjectedUS$38billionintobanksthreetimesaday.Stabilizethestockmarket

August14ThethreemajorcentralbanksintheUnitedStates,EuropeandJapanonceagaininjectmorethan72billionUSdollarstorescuetheAsia-Pacificcentralbankandtheninjectcapitalintothebankingsystemofvariouseconomiesorpostponeinterestratehikesp>

August14DozensofcompaniesincludingWal-MartandHomeDepotannouncedthattheyhadsufferedhugelossesduetothesubprimedebtcrisis.USstockssoonfelltotheirlowsinseveralmonths.

August16thTheU.S.’slargestcommercialmortgagecompany’ssharepriceplummeted,facingbankruptcy,theU.S.subprimedebtcrisisworsened,andAsia-Pacificstockmarketssufferedtheirworstdeclinesince9/11.

AugustOnthe17ththeFedloweredthewindowdiscountrateby50basispointsto5.75%

August20theBankofJapaninjectsanother1trillionyenintothebankingsystem.TheEuropeanCentralBankplanstoStepupeffortstorescuethemarket

August21TheBankofJapaninjects800billionyenintothebankingsystemandtheReserveBankofAustraliainjects3.57billionAustraliandollarsintothefinancialsystem

August22ndTheFedinjectedanotherUS$3.75billionintothefinancialsystem.TheEuropeanCentralBankadded40billioneurostorefinancingoperations.

August23Banklends314millionpoundstorespondtothecrisis,theFedinjectsanother7billionUSdollarsintothefinancialsystem

August28TheFederalReserveinjectsanotherUS$9.5billionintothefinancialsystem

August29TheFederalReserveinjectsanotherUS$5.25billionintothefinancialsystem

p>August30TheFedwillinjectanotherUS$10billionintothefinancialsystem

August31BernankesaidtheFedwillworkhardAvoidingthecreditcrisisfromdamagingeconomicdevelopmentBushpromisedthatthegovernmentwilladoptapackageplantorescuethesubprimemortgagecrisis

September18TheFederalReserveloweredthefederalfundsrateby50basispointsto4.75%ThedebtcrisisaffectedtheBritishNorthRockBank,whichwasrunontobesplitandsoldDayTheBankofEnglandannounceda25basispointcutininterestrates.Bushannouncedasubprimemortgagereliefplan.

December12TheFederalReserveannounceda25basispointcutininterestratesandloweredthediscountrateto4.75%

December13TheU.S.andEuropeanCentralBanksjoinedforcestorespondtothecreditcrisis

2008

January15Citiannouncedthatthebanklost9.83billionU.S.dollarsinthefourthquarterandsaiditwouldraise12.5billionU.S.dollarsthroughpublicofferingsandprivateplacements.

January17MerrillLynchlost9.83billionU.S.dollarsinthefourthquarter,alossof12.01U.S.dollarspersharefromayear-on-yeargainof241million.

January22TheFederalReserveannouncedthatitwillcutthefederalfundsrateby75basispointsto3.50%andtheovernightlendingrateby75basispointsto4.00%

OnJanuary30th,SwissBankannouncedthatitisexpectedtosufferalossofapproximatelyUS$11.4billioninthefourthquarterof2007,draggeddownbythesubprimemortgageassetoffsetofuptoUS$14billion.

January31TheFederalReserveloweredthefederalfundsrateby50basispointsto3.0%andthediscountrateby0.5%to3.5%.

March12TheFederalReserveannouncedthatitwillexpanditssecuritieslendingprogram,lendingupto$200billioninTreasurybondstoitsprimarydealers.

March16TheFederalReservedecidedtolowerthediscountratefrom3.5%to3.25%andcreateanewdiscountwindowfinancingtoolforjuniortraders.

September7TheFederalHousingFinanceAdministrationwilltakeoverFannieMaeandFreddieMac

September14b>BankofAmericaandMerrillLynch,thethirdlargestinvestmentbankintheUnitedStates,havereachedanagreementonthe14thtoacquirethelatterforapproximatelyUS$44billion.

September15LehmanapplicationThelargestbankruptcyprotectiondebtinU.S.historyexceedsUS$613billion,Thepriceisonly30%ofthepeakvalueofMerrillLynch’sstockprice.

September17LessthantwodaysafterLehmanBrothersfiledforbankruptcyprotection,theFederalReservesetaprecedentbyannouncingaUS$85billionemergencyloantothethreateningAmericanInternationalGroup(AIG).Takeoverthegroupindisguise.

September18ThesixcentralbanksheadedbytheFederalReserveonceagainjoinedforcesandannouncedajointinjectionofupto180billionU.S.dollarsintothefinancialsystemtoeasethetightnessofthemoneymarket.

September21ThelasttwoofthefivemajorindependentinvestmentbanksonWallStreethavechangedtheircourse–MorganStanleyandGoldmanSachshavebeenapprovedtobecomebankholdingcompaniesandaccepttheFederalReserveSupervision.

September24TheFederalBureauofInvestigation(FBI)launchedaloanfraudinvestigationintocompaniessuchasLiangfangandLehman.

September25thJPMorganChase&Co.,thethirdlargestbankintheUnitedStates,acquiredthetroubledUnitedStates’largestdepositandlendinginstitutionWashingtonMutualBankfor$1.9billion.

September30thU.S.stocksexperiencedaBlackMonday,theDowfell6.98%,settingthelargestpointdropinhistoryandthelargestone-daydropsincethe"911"incidentin2001.

October8TheFederalReserve,EuropeanCentralBank,BankofEngland,etc.cutinterestratesby50basispoints;Chinacutinterestratesby27basispointsandsuspendedinteresttaxes.

October13Japan'sYamatoLifeInsuranceCompanyappliedtothecourtforcreditorprotection,becomingJapan'sfirstfinancialinstitutiontogobankruptduringthefinancialcrisis.

November8TheG20FinanceMinistersandCentralBankGovernors2008AnnualMeeting9openedinSaoPaulo,Brazil.Theparticipantsagreedthatthereisaneedtoreformtheinternationalfinancialsystem.Takejointactiontodealwiththeglobalfinancialcrisis.

December29Asthefinancialcrisisdeepens,forthefirsttimeinhumanhistoryin2009,asmanyas1billionpeoplewillgohungryduetofoodshortages.

December30Undertheimpactofthefinancialcrisis,export-orientedJapanesecompaniessufferedaheavyblow.Bytheendof2009,Japan’sautomobilemanufacturingindustryalone100,000employeeswillbefired.

In2009

January7TheU.S.governmentofficiallyprovidedCitigroupwithaUS$20billionemergencyloan

1Onthe19thBritishPrimeMinisterBrownonceagainannouncedthelaunchofalarge-scalefinancialrescueplanonthe19thtopromotebankloans.

January24Microsoft’ssecond-quarternetprofitfell11%andplanstolayoff5,000employees.

January27OctobersalesintheU.S.automarketfellby32%comparedtothesameperiodin2007,whichistheworstlevelintheU.S.automarketsince1991.

February4thThenewUSPresidentBarackObamaactivelyurgedtheUSSenatetopassaneweconomicstimuluspackagetotalingUS$819billiontosavetheUSeconomy.

February5Hitachipredictsthatthelossinfiscalyear2008mayreach700billionyen(equivalenttoUSD7.8billion),whichistheemergenceofAsiancompaniessincetheoutbreakofthesubprimemortgagecrisisintheUnitedStatesMaximumannualloss.

February6thToyotaJapanannouncedthatitwillhaveitsfirstannualnetlossindecades,andthecompany’sperformancewillchangefromtheoriginallyestimatednetprofitof50billionyento350billiondaysYuannetloss.

February10thUBSGroupreleaseditsquarterlyreport,showingthatthegrouphadalossofapproximatelyUS$6.9billioninthequarter,mainlyduetothelossofinvestmentbankingriskpositionsandannuallosses.US$17billion

February11CreditSuisselost6.02billionSwissfrancsinthefourthquarterandplanstolayoff5,200employees

February12TheU.S.Chamberandthetwochambersreachedacompromise,andthefinaltextofthenewgovernment’seconomicstimuluspackagewithatotalvalueof$798billionwasformed

February15Japan’sGDPcontractedby12.7%,adropofmorethanItispredictedthatitwillbetheworstsincetheoilcrisisin1974.

February19TheUSeconomicstimulusplanwithascaleof787billionUSdollarshasfinallysettled.ThisistheUnitedStatessince"ThemostmassivestimuluspackagesincetheGreatDepression

February24Theeconomiccrisis’simpactonEasternEuropeancountriessuchasHungaryandPolandhasdeepened.EasternEuropeancountriesmayconsidernotrepayingtheirdebts,andthe"secondwave"offinancialcrisisconcernsspread

February27TheUSgovernmentreachedanequityswapagreementwithCiti,andtheUSgovernmentisinCitiTheshareholdingratioofRBSwillriseto36%.Onthesameday,theRoyalBankofScotland(RBS)announcedahugelossof24.1billionpoundsinthe2008fiscalyear,andtheBritishgovernmentguaranteed325billionassets.

March2AIG’sfourth-quarterfinancialreportshowedthatitlostahugelossofUS$61.7billioninthequarter,settingthelargestsingle-quarterlossinthehistoryofaUScompany.Equivalenttoalossof$22.95pershare.

March6TheBankofEnglandandtheEuropeanCentralBankhavesuccessivelyloweredtheirbenchmarkinterestratesby50basispoints,to0.5%and1.5%respectively,andtheirrespectivebenchmarkinterestrateshavefallentotheirhistoricallowslevel.

March9Russiahasexhausted35%ofitsforeignexchangereservesinthepastfivemonths,GDPfellby8.8%year-on-yearinasinglemonth,andindustrialproductionoutputfellby16%year-on-year,hitting15Thebiggestdropinayear.

March11CitiannouncedthatitachievedaprofitofUS$19billioninJanuaryandFebruary2009,almostreachingtheprofitofUS$21billioninthefirstthreemonthsof2008.TheDowsoaredby5.8%,thelargestincreasein2009Onthethirdtradingday,itrosebymorethan600points.

Impact

Theoccurrenceoftheglobalfinancialcrisishasseverelyaffectedtheworldeconomyandseriouslyaffectedtheorderofpeople’sdailylives.

TakethesubprimemortgagecrisisintheUnitedStatesasanexample.Fromtheperspectiveofitsdirectimpact,thefirsttobeimpactedaremanyhomebuyerswithlowincomes.Duetotheinabilitytorepaytheloan,theywillfacethedifficultsituationofhousingbeingrecoveredbythebank.Secondly,inthefuture,moresubprimemortgagelendinginstitutionswillsufferseverelossesduetothefailuretocollectloans,andwillevenbeforcedtoapplyforbankruptcyprotection.Finally,asmanyinvestmentfundsintheUnitedStatesandEuropebuyalargenumberofsecuritiesinvestmentproductsderivedfromsubprimemortgages,theywillalsobehithard.

IntheU.S.subprimemortgagecrisis,thebankingindustryisthefirsttobehit.PayingattentiontothehiddenrisksbehindhousingmortgageloansisacurrentissuethatChinesecommercialbanksshouldpayspecialattentionto.Intheperiodwhentherealestatemarketisgenerallyrising,housingmortgageloansarehigh-qualityassetsforcommercialbanks,withrelativelyhighloanyieldsandlowdefaultrates.Oncedefaultsoccur,theycanbecompensatedbyauctioningmortgagedrealestate.Atpresent,realestatemortgageloansaccountforalargeproportionoftheassetsofChinesecommercialbanks,andtheyarealsooneofthemainsourcesofloanincome.AccordingtotheNewBaselCapitalAccord,theriskprovisionsofcommercialbanksforrealestatemortgageloansarerelativelylow.However,oncetherealestatemarketpricesgenerallyfallandmortgageinterestratesrisesimultaneously,thedefaultrateofbuyers'repaymentwillrisesharply,andthevalueoftherealestateafterauctionmaybelowerthanthetotalprincipalandinterestoreventheprincipalofthemortgage,whichwillleadtocommercialbanks.ThebaddebtratioofChinahasincreasedsignificantly,whichhasanimpactontheprofitabilityandcapitaladequacyratioofcommercialbanks.AlthoughitisunlikelythatpriceswillgenerallyfallintheChineserealestatemarketinthenearterm,inthelongrun,theriskofmortgageloanissuanceinthebankingsystemcannotbeignored.Strictloanconditionsandloanreviewsystemsmustbeimplementedatthisstage.

Atthesametime,thesubprimemortgagecrisishasalsohadagreatimpactonChina'seconomy.

First,thesubprimemortgagecrisismainlyaffectsChina’sexports.

ThesubprimemortgagecrisishascausedaslowdownintheU.S.economyandglobaleconomicgrowth.TheimpactontheChineseeconomycannotbeignored,andthemostimportantoneistheimpactonexports.In2007,duetoweakimportdemandintheUnitedStatesandEurope,mycountry'smonthlyexportgrowthratehasdroppedfrom51.6%inFebruary2007to21.7%inDecember.TheUSsubprimemortgagecrisishascausedadeclineinmycountry’sexportgrowth.Ontheonehand,itwillcausemycountry’seconomicgrowthtoslowdowntoacertainextent.Atthesametime,duetotheslowdownofmycountry’seconomicgrowth,thedemandforlaborislessthanthesupplyoflabor,whichwillputpressureontheemploymentoftheentiresociety.Increase.

Secondly,mycountrywillfacethedualpressureofslowingeconomicgrowthandsevereemploymentsituation.

Therealeconomy,especiallytheindustry,isfacingtremendouspressure.Theclosureofalargenumberofsmallandmedium-sizedprocessingenterpriseshasalsoexacerbatedthegrimsituationofunemployment.

Finally,thesubprimemortgagecrisiswillincreaseChina’sexchangerateriskandcapitalmarketrisk.

Inresponsetothenegativeimpactofthesubprimemortgagecrisis,theUnitedStateshasadoptedaloosemonetarypolicyandaweakUSdollarexchangeratepolicy.ThesharpdepreciationoftheUSdollarhasbroughthugeexchangerateriskstoChina.Withtheeconomicslowdownindevelopedcountries,thecontinuedgrowthoftheChineseeconomy,thecontinueddepreciationoftheU.S.dollarandtheexpectedappreciationoftherenminbi,theacceleratedflowofinternationalcapitaltomycountryinsearchofasafehavenwillintensifyrisksintheChinesecapitalmarket.

Relatedevents

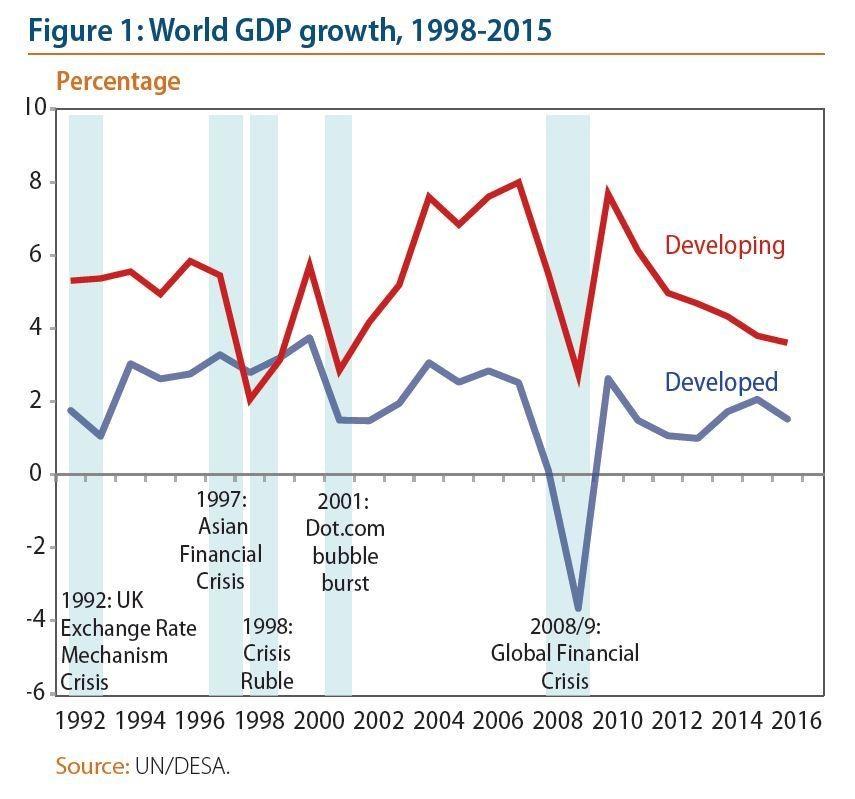

Afterenteringtheindustrialage,economicandfinancialcriseshavealwaysbeenaccompaniedbyintermittentoutbreaksofhumaneconomicdevelopment.Sincethe20thcentury,majoreconomiccrisesandfinancialcrisesthathaveoccurredaroundtheworldmainlyinclude:

1929to1939:TheGreatDepression

TheWallStreetstockmarketcrashedintheUnitedStates,andadevastatingeconomicdepressionsweptalmostallindustrializedcountriesandlastedfortenyearsinsomecountries.DuringtheGreatDepression,thehighestunemploymentrateintheUnitedStatesreached25%,andtheunemploymentratesinGermany,Australia,andCanadawereoncecloseto30%.TheU.S.economyhitatroughin1933,andindustrialoutputfellto65%ofitspre-recessionlevel.

1973-1975:Economiccrisistriggeredbytheoilcrisis

InOctober1973,thefourthMiddleEastwarbrokeout.InordertocombatIsraelanditssupporters,theOrganizationofArabPetroleumExportingCountriesannouncedanoilembargoontheUnitedStatesandothercountries,andatthesametimejoinedotheroil-producingcountriestoincreaseoilprices,whichledtotheoutbreakoftheoilcrisis.ThiscrisistriggeredtheworsteconomiccrisissinceWorldWarIIinmajorindustrialcountries.IndustrialproductionintheUnitedStatesfellby14%,andindustrialproductioninJapanfellbymorethan20%.

The1980s:LatinAmericadebtcrisis

Sincethe1960s,LatinAmericancountrieshaveaggressivelyincreasedtheirforeigndebttodevelopdomesticindustries.Thetotalamountofforeigndebtwasinthe1980s.Atthebeginning,itexceeded300billionU.S.dollars.In1982,Mexicodeclareditsinabilitytorepayitsforeigndebts,triggeringa"debtcrisis"thatshooktheworld.ThedebtproblemhasseverelyhinderedtheeconomicdevelopmentofLatinAmerica.In1988,thepercapitaGDPofLatinAmericancountrieswasonlyUS$1,800,returningtothelevelofthe1970s.

1990sEss:Japan’sbubbleeconomycollapsed

In1990,Japan’srealestateandstockmarketscontinuedforseveralyearsAftertheexcessivegrowth,acatastrophicdeclinebegan.Duetotheoverallshrinkingofassets,Japanhasexperiencedalongperiodofdeflationandeconomicrecessionin10years.Inthemid-1990s,Japan'seconomicgrowthstagnatedandentereda"zerogrowthstage."

1997-1998:AsianFinancialCrisis

UnderthebackgroundofrisinginterestratesintheU.S.andappreciationoftheU.S.dollar,exportsfromAsiancountrieswhosecurrenciesarelinkedtotheU.S.dollarcontinuetodecline.InJuly1997,asThailandannouncedtheimplementationofafloatingexchangeratesystemfortheThaibaht,Asiancountriesgenerallyexperiencedcurrencydevaluationsandafinancialcrisisbrokeout.Inthiscrisis,Indonesia,Thailand,andSouthKoreaarethecountriesthathavesufferedthemost.TheGDPofthethreecountrieshasshrunkby83.4%,40%and34.2%respectivelyintwoyears.

2007-2011:U.S.SubprimeMortgageCrisisandGlobalFinancialCrisis

Foralongtime,U.S.financialinstitutionshaveblindlyissuedsub-credithomebuyersMortgage.Withrisinginterestratesandfallinghousingprices,thesubprimemortgagedefaultratecontinuedtorise,whicheventuallyledtotheoutbreakofthesubprimemortgagecrisisinthesummerof2007.Thecrisisledtothebankruptcyofcompaniesandinstitutionsthatoverinvestedinsubprimefinancialderivatives,andtriggeredseverecreditcrunchesworldwide.

TheU.S.subprimemortgagecrisisfinallytriggeredaglobalfinancialcrisis.InSeptember2008,thebankruptcyofLehmanBrothersandtheacquisitionofMerrillLynchmarkedthefulloutbreakofthefinancialcrisis.Asthedisasterofthevirtualeconomyspreadstotherealeconomy,theeconomicgrowthofcountriesaroundtheworldhassloweddown,theunemploymentratehassoared,andsomecountrieshavebeguntoexperiencesevereeconomicrecessions.

Relatedmeasures

Aftertheglobalfinancialcrisis,variouscountrieswilltakerelevantmeasurestopreventthespreadoftheincidentorminimizetheharm.

TaketheUSsubprimemortgagecrisisin2007asanexample.Aftertheoccurrence,theChinesegovernmentintroducedaseriesoffiscalandmonetarypoliciestoensurethestabledevelopmentoftheeconomy.

Fiscalpolicy:

(1)Loosefiscalpolicy:reducetaxation(thereductionofsecuritiestransactiontaxandtheabolitionofinteresttaxhavebeenimplemented),andexpandgovernmentexpenditure(drivenby40billionyuan)Domesticdemandisbeingimplemented);

(2)Promotingforeigntrade:Theimportandexportindustryisthefirsttobeaffected,andtherearemanyemployees(accordingtostatistics,ithasreached100millionpeople).Oneistoincreasetheexporttaxrebate;theotheristheappreciationoftherenminbi,whichisameanstoincreaseexportcompetitiveness;(3)reducetheburdenonenterprises:adjustmentoflaborlaws,etc.;

(4)Strengthenpublicfinancialexpendituresonsocialsecurity/medicalservices,andmaintainthestabilityofthesocialandeconomicdevelopmentenvironment.;

(5)Industrialrevitalizationplan.

Monetarypolicy

(1)ThemonetarypolicyhasbeenadjustedinatimelymannersinceJuly2008.Reducethehedgingeffortsintheopenmarket,successivelysuspendtheissuanceof3-yearcentralbankbills,reducethefrequencyofissuanceof1-yearand3-monthcentralbankbills,andguidecentralbankbillissuanceratestofallappropriatelytoensureliquiditysupply.

(2)Loosemonetarypolicy.InSeptember,October,November,andDecember,thebenchmarkinterestratewascontinuouslylowered,thedepositreserveratiowaslowered,thedepositreserveratiofell,andthebenchmarkloaninterestratefell.Thepurposewastoincreasethemoneysupplyinthemarketandexpandinvestmentandconsumption.

(3)OnOctober27,2008,a30%discountforthefirsthousingloaninterestratewasimplemented;residentsweresupportedtopurchaseordinaryself-ownedhousingandimprovedordinaryhousingforthefirsttime.

(4)Therestrictionsonthecreditplanningofcommercialbankshavebeenlifted.

(5)Insistondifferentiatedtreatment,withholdingsandpressures,andencouragefinancialinstitutionstoincreaseloansforreconstructionofdisaster-strickenareas,"agriculture,ruralareas,andsmallandmedium-sizedenterprises."

(6)Foreigneconomiccooperationandcoordination(suchascurrencyswapsbetweenChina,JapanandSouthKorea,etc.)

Reflection

1.GovernmentmarketRelationship:Supervisioncannotbeabsentfrom"financialinnovation"

Therealityhasprovedtherootcauseofthecrisis---theUnitedStates’oversightofthecrisis.

ThisoversightisreflectedinmanyOntheonehand,themostimportantthingistheweakeningofgovernmentsupervision,whichhasledtotheexcessiveexpansionofmarketpower,whichseemstohaveopenedPandora’sbox.Financialinnovationundertheabsenceofsupervisionhascloselylinkedtherealestatemarketwiththecapitalmarket,andhighleveragehasincreasedrisks.Expansion.Manyfinancialinnovationproductshavedevelopedtoapointwherealmostnoonecanunderstand.Finally,thereiscollusionbetweenratingagenciesandinvestmentbanks,thatis,acollusionbetweenmarketsupervisorsandproductcreatorsandsellers.

2.Internationalcooperationresponse:Itisimportantforgovernmentstoworktogether

Intermsofcrisisresponse,amajorlessonliesinthetimingandconsistencyofgovernmentresponse.ReviewtheUSgovernmentObjectivelyspeaking,manypolicieshaveshownresultsinresponsetothefinancialcrisis.Thefinancialmarkethasstabilized.AftertheNewYorkstockmarkethasreturnedtoitsupwardtrend,therealestatemarkethasimprovedandconsumerconfidencehasrecoveredsignificantly.

3.Short-termemergencymeasures:moreemphasisshouldbeplacedonthesustainabilityofdevelopment

AlanKrueger,ChiefEconomistandAssistantSecretaryforEconomicPolicyoftheUSTreasuryDepartmentInaninterviewwiththe"EconomicInformationDaily"reporter,hesaidthatreflectingonthelessons,thiscrisishasmadeAmericansrealizethatthepastfoodandexcessivedebtconsumptionareunsustainableandwillreduceimportsandincreaseexports.Inaddition,theUnitedStateshasrealizeditsownfinancialsector.Inordertolaythefoundationforfuturedevelopment,large-scalefinancialreformsarebeingadopted,includingstructuraladjustments,strengtheningconsumerfinancialprotection,andrestrictingspeculationinfinancialderivatives.Countriesaroundtheworldareactivelylookingforstrategiesforsustainabledevelopmentafterthecrisis.LookingatthesourceofthecrisisintheUnitedStates,ontheonehand,theU.S.governmenthasimplementedfinancialreformsandstimulatedeconomicgrowthathome,ontheotherhand,ithaspromotedtherebalancingoftheworldeconomyinternationally.