Introduction

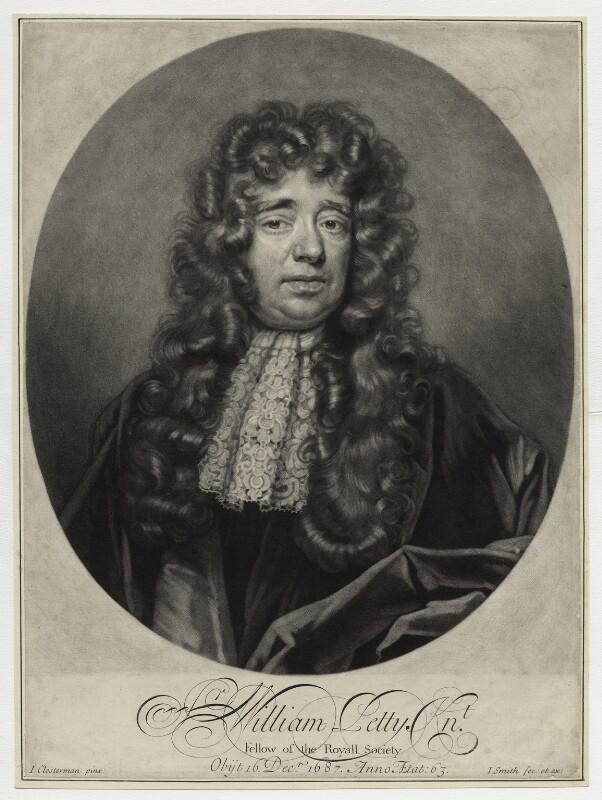

WilliamPettywasborninafamilyofhandicraftsmenintheUK,andhasworkedinmanyoccupations,fromwaitersonmerchantships,sailorstodoctors,andprofessorsofmusic.Heissmart,hard-working,daringtotakerisks,andgoodatspeculation.Inhislateryears,hebecameabiglandlordwithlargetractsofland.Healsofoundedfisheries,ironsmeltingandaluminumminingenterprisessuccessively.MarxhatedPetty’scharacter,sayingthathewasa"veryfrivoloussurgicalmedic"anda"frivolity,predatory,unscrupulousadventurer";however,hegavehimahighregardforhiseconomicthinking.Heiscalled"thefounderofmodernpoliticaleconomy","themostgeniusandmostinnovativeeconomicresearcher","thefatherofpoliticaleconomy,andtoacertainextentstatistics.Founderof".

Thetimesmakeheroes,andthegreatdevelopmentoftheBritishbourgeoisiehasmadesucha"frivolous"adventurerthe"fatherofpoliticaleconomy."Inthemiddleofthe17thcentury,workshophandicraftshadbecomethemainformofproduction,andBritainhadbecomethemostindustrializedcountryintheworld.Correspondingly,capitalistproductionrelationshavereachedthemostdevelopedlevelinBritain.ThisistheeconomicbasisonwhichtheBritishcanfirstproduceclassicalpoliticaleconomy.

ThevictoryoftheBritishbourgeoisrevolutionlaidtheclassfoundationforthefirstgenerationofclassicalpoliticaleconomyinBritain.ThebourgeoisrevolutionbrokeoutinBritainin1640.ThecapitalisteconomyinBritaindevelopedrapidly.Thehandicraftindustryintheworkshopsbecamemoreandmoreprosperous.Industrialcapitalgraduallyreplacedcommercialcapitaltooccupyanimportantpositioninthesocialeconomy.Pettyrepresentedtheinterestsanddemandsoftheemergingindustrialcapital,andheactivelywroteandstatedthathesoughtatheoreticalbasisforBritaintorulecoloniesandseizeworldhegemony.Itwasfromthistimethathebegantostudyeconomics.

WilliamPettyseemstohavebeenforgottenbystatistics."PoliticalArithmetic"writtenbyhim,firstlybecauseitwasbornafterAristotle,andduetothereasonsofthetimes,therearefewdataobtainedthroughstrictstatisticalinvestigation,butmoredatabasedonexperience.Secondly,inpeople'sunderstandingofstatistics,peopleoftenonlypayattentiontothedataobtainedfromstatisticalsurveys,andignoretheinfluenceofcollectingandanalyzingdataonstatistics.AlthoughAristotlepioneeredstatistics,itwasonlyamerestatisticalinvestigation,andWilliamPettyledstatisticsintoaneweraofdatacollectionandanalysis.

Theadventof"PoliticalArithmetic"markedthebirthofstatistics."PoliticalArithmetic"isaworkthatusesquantitativemethods(thatis,"arithmetic")tostudysocialissues(thatis,"politics").Inthebook,WilliamPettymadeaquantitativecomparativeanalysisofthenationalconditionsandnationalstrength(mainlyeconomicstrength)ofBritain,France,andtheNetherlandsonthebasisofthelabortheoryofvalue.Basedonthis,hemadesuggestionsforthedevelopmentoftheBritishsocietyandeconomyatthattime..

"Taxation"

WilliamPetty'smostfamouseconomicsbookis"Taxation"(1662).Althoughhiseconomicworksareallaboutthemaineconomicproblemsthatexistedinthesocietyatthattime,anddidnotformacompletetheoreticalsystemofpoliticaleconomy,hewasnotsatisfiedwiththephenomenalexplanationoftheactualeconomicproblems,butstrivedtoexploretheemergenceofeconomicphenomena.Naturalbasis.Heopposedmakinginferencesbasedonsubjectivewishesandproposedtofindthenaturalbasisofeconomicphenomenafromspecificstatisticaldata.Asaresult,hegotridoftheinfluenceofmercantilism,transferredthestudyofpoliticaleconomyfromthefieldofcirculationtothefieldofproduction,andexaminedtheinternalrelationsofcapitalistproduction.

Maincontribution

Itwasthefirsttoputforwardthebasicprinciplethatlabordeterminesvalue,andonthebasisoflaborvaluetheory,heexaminedthecategoriesofwages,landrent,interest,etc.,hetooklandrentWorkisthebasicformofsurplusvalue.Pedidistinguishesbetweennaturalpriceandmarketprice.Hisnaturalpriceisequivalenttovalue.HepointedoutthatifapersonproducesabushelofwheatinlabortimeequaltothelabortimerequiredtoproduceanounceofsilverfromPeruviansilverminesandtransportittoLondon,thelatteristhenaturalpriceoftheformer.ItcanbeseenthatPettybelievesthatthelabortimespentinproducingcommoditiesdeterminesthevalueofcommodities.Healsoproposedthatthevalueofcommoditiesisinverselyproportionaltolaborproductivity.However,hedidnotmakeacleardistinctionbetweenvalue,exchangevalueandprice.Heregardedtheconcretelaborofproducingsilverasvalue-creatinglabor,andhedidnotunderstandthatitwasabstractlaborthatcreatedvalue.Healsoputforwardtheviewthat"laboristhefatherofwealth"and"landisthemotherofwealth".Fromthis,hebelievesthatlaborandlandcreatevaluetogether.Obviously,thisviewiscontradictorytohislabortheoryofvalue.Itconfusestheproductionofusevalueandthecreationofvalue.

WilliamPetty’sabilitytobecomethe"fatherofpoliticaleconomy"isstilllargelyduetohispersonalexperienceandqualityaswellasthenewresearchmethodsformedonthisbasis.Attheageof14,heshowedarebelliouspersonalitytowardshisparents,wenttoseaandpursuedafreelife.Hewasobsessedwithscience,especiallymedicine(1644-1645,hestudiedmedicineatLeidenUniversityintheNetherlands,andthenwenttoFrance,HepracticedmedicineandengagedinacademicresearchintheUnitedKingdom.In1649,heobtainedadoctorateinmedicinefromtheUniversityofOxford.HebecameadoctorandconcurrentlyaprofessoroftheRoyalCollegeofMedicine.Theprecisevisionoflearningexamineseconomiclife,andhisspeculativecareerhasalsogivenhimanempiricalunderstandingofthelawsofeconomicoperation.HealsoservedasthesecretaryofthegreatphilosopherHobbes,whichinturnenabledhimtorealizetheinnovationofeconomicresearchmethodologywhenheexploredeconomicissues.

Publishingbooks

Theoreticalviewpoints

TaxThesourceof

Pedi’seconomicthoughtistheso-called"laboristhefatherofwealth,andlandisthemotherofwealth".

Hebelievesthattherealsourceofsocialwealthislandandlabor,andtheultimateobjectoftaxationcanonlybelandrentanditsderivedincome.Heregardedlandrentastheproductofsurpluslabor,andthustheultimatesourceoftaxes.

Theeconomicimpactoftaxation

WilliamPettydeeplyanalyzedtaxationandnationalwealth,taxationandTherelationshipbetweennationaleconomicpower.Hebelievesthattheincreaseordecreaseofnationalwealthisthemainindicatoroftheeconomiceffectoftaxation.Hesaidthatiftaxesareleviedonpeoplewhoengageinproductionandtradeactivitiesthatincreasematerialwealthtosociety,society’swealthwilldecrease;onthecontrary,iftaxesareleviedonpeoplewhodonotproduceanykindofmaterialwealthorgoodsofactualvaluetosociety,Andtransfertaxrevenuetotheformercategoryofpeople,andusethecapitalinthefieldofproduction,socialwealthwillincrease.Hepointedoutthatthegovernmentcanusetaxationtoguidepeopletostartnewproductionundertakingsandincreasesocialwealth."Ifacountryforcespeoplewhohavenotyetobtainedfullemploymenttoengageintheproductionofgoodsthathavealwaysbeenimportedfromabroad,orimposestaxesonthesepeopletoforcethesepeopletoengageintheproductionofthesegoods,IthinkthistaxwillalsomakeIncreaseinpublicwealth".

Principlesoftaxation

Paidarticleproposedtaxation"fairness","reliability","convenience"and"convenience"inresponsetothevariousshortcomingsoftheBritishtaxationsystematthetime.Fourprinciplesofsaving".Hepointedout:"Thesetaxesarenotleviedbasedonafairandunbiasedstandard,butaredeterminedbythemomentarypowerofcertainpoliticalpartiesorfactions.Notonlythat,theproceduresforlevyingthesetaxesarenoteasy.,Thecostisnotsaved,itisleviedbythetaxcontractor,andthetaxcontractordoesnotknowexactlywhattodotobeconsideredreasonable,soitsubcontractsthetaxcollectionpowerlevelbylevel,sothatintheend,thepoorarelevied.Theamountoflevyactuallyreachedtwicetheamountactuallyreceivedbytheking."Pettybelievesthatthetaxpackagesystemviolatestheprincipleoffairnessandcertainty;polltaxcannotbepaidaccordingtoability,whichisunfair;intermsofpaymentmethod,itisinconvenienttopaytaxesonlyincurrency,anditwillalsobringconsumption.

Theoriesonvarioustaxes

Inthe"OnTaxation",Pedidiscussestariffs,polltaxes,tithes,domesticconsumptiontaxes,etc.Taxtypes.Hebelievesthatthepolltaxisataxsystemleviedontheperson.Thepoorertheperson,theheavierthetaxburdenandthemostharmful.

Taxperspective

Tariff

Paidibelievesthatitisataxofthenatureofinsurancepremiums,andthetaxrateshouldnotbetoohigh.HebelievesthattherearemanyshortcomingsinBritishtariffs.Forexample,thetargetoftariffsissemi-finishedproducts,whichisnoteconomical;thecollectionoftariffsrequiresalotofofficials;peopletendtosmugglethroughbribery,collusion,concealment,anddisguise.Tothisend,heproposedtoreformtariffs.Therearetwoplans:oneistolevyatonnagetaxonallimportandexportvesselsinsteadoftariffs;theotheristochangetariffsintoinsurancepremiumsforeasyadjustment.

Headtax

Therearetwotypesofheadtax,oneisleviedoneveryonewithoutdistinction;theotherisleviedoneveryonebytitleortitle.Pettybelievesthatthefirsttypeofpolltaxhasseveraladvantages."First,itisleviedquicklyandcostsless.Second,thepopulationfiguresarealwayswell-known,sotheamounttobeleviedcanbeaccuratelycalculated.Third,Itwillstimulateallpeopletolettheirchildrenengageinsomekindofbeneficialoccupationaccordingtotheirspecialties,sothatthechildrencanusetheirincometopaytheirownpolltax."

However,Pettypointedoutthis.Thistaxisveryunfair,becausepeoplewithdifferentabilitiespaythesametax,andthepersonwhobearsthemostchildren'sexpensespaysthemosttax.Thesecondtypeofpolltaxisfairerthanthefirst,becausepeoplewithtitles(suchashonor,position,status)andtitlesaremostlywealthypeople,andtheyshouldpaymore.

Domesticconsumptiontax

Althoughtheconsumptiontaxisunfair,suchastheunfairtaxationofgeneralbeerandstrongbeer,Pettyactivelyadvocatesthecollectionofconsumptiontax.Thereasonsare:First,thistaxisleviedaccordingtotheactualenjoymentofeachperson,whichisinlinewithnaturaljustice.Itdoesnotstrengthenthesystemforanyone,andthetaxburdenonpeoplewithlowincomeisextremelylight;second,iftheconsumptiontaxisnotataxpackagebutadirectstateIfleviedandreasonable,itcanencouragepeopletobethriftyandincreasenationalwealth;third,becausepeoplecanonlyconsumeanyitemonce,theywillnotpaytwiceortwicethetaxonthesameitem;fourth,theimplementationofthistaxcanbeMakeaccuratecalculationsofthecountry’swealth,production,tradeandstrengthatanytime.

Tithe

Hebelievesthatthisisasalaryleviedbythesaintsonthefruitsofproduction.Astherearemoreandmoreincompetentpriestsandtheburdenoftithingisgettingheavierandheavier,itshouldbegraduallyreduced.Regardingtariffs,hepointedout:“Thistariffwasoriginallyarewardgiventothemonarchtoprotectthetransportationofimportedandexportedgoodsfrompirates.”Therefore,hebelievesthattariffsareaninsurancepremium.Atthesametime,hebelievesthatimposingtaxesonsemi-finishedproductsrequirestheadditionofmanyofficials.Itiseasytosmugglegoodsthroughbribery,andtolevytaxesonasmallnumberofgoodsproducedintheUKforexchangewithforeigngoods.Thesearethefourmajordrawbacksoftariffs.Regardingdomesticconsumptiontax,Pettybelievesthatthebestwaytolevytaxistoimplementdomesticconsumptiontax.Headvocatedadomesticconsumptiontaxforthewholepeople.Hebelievedthatthedomesticconsumptiontaxcouldincreasethedirectproportionaltaxleviedontheproperty-owningclass,anditplayedanimportantroleintheoriginalaccumulationofBritishcapital.